In the past, I’ve written various posts about shorting US homebuilders. This post look at lessons that could be learned from the experience. I was largely right about which companies were the worst. However, I was hurt by the favorable macroeconomic environment for homebuilders.

Some of my posts about shorting homebuilders

- (Sept 2012) KB Home (KBH) short thesis

- (June 2013) US Homebuilders: Time to Short Them?

- (July 2013) Hovnanian (HOV)

- (July 2013) AV Homes (AVHI)

- (July 2013) Comstock Holding Companies (CHCI) – The living dead

Identifying the worst companies

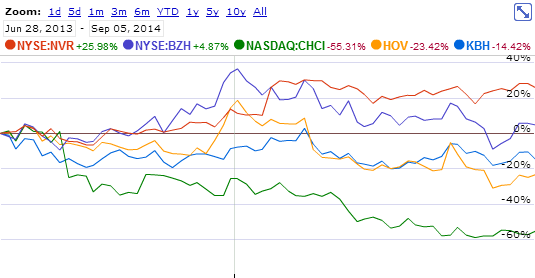

In my post “US Homebuilders: Time to Short Them?“, I thought that BZH, CHCI, HOV, and KBH were worth shorting. Of those, I did not short BZH and did not do a writeup on it. I thought that NVR was the best managed homebuilder out there. Here’s how those stocks performed since then:

It turns out that I was right about the relative performance of these companies. This suggests that I did a reasonable job at analyzing (A) the valuations of these companies and (B) the quality of their management teams.

Nonetheless, I managed to lose money shorting homebuilders. I shorted KBH too early and lost money. I did not have a full-sized position in CHCI because I did not feel like paying the expensive borrow. Ultimately however, I think that my main shortcoming was underestimating the rebound in orders of new homes.

Macro investing

With the benefit of hindsight, we can see that orders for new homes started picking up around 2012-2013. Had I done more research into the market, perhaps I could have correctly predicted that the industry would experience improving fundamentals. While I wasn’t bearish on housing, I wasn’t sufficiently bullish.

The big picture is that housing has been in a bear market for a very long time. Here’s a rough history:

- 2005: The profits and share prices of homebuilders peaked.

- 2007: Dumb mortgages peaked. This was the apex of option ARMs with teaser rates, no income verification, etc.

- 2008-2009: All asset classes fell in price. A lot of the excess went away as many homebuilders went bankrupt.

- 2009 onwards: Foreclosures from dumb mortgages slowly work their way through the system. The government introduced massive subsidies to prop up the housing market and to avoid foreclosures.

- 2012-2014: Homebuilders see a very healthy rise in new orders.

Some people who were smarter and also more hard-working than me correctly predicted the bottom in 2012. Ivy Zelman is perhaps the most notable analyst. She is credited with becoming bearish on homebuilders in 2005 and becoming bullish in January 2012. In a March 7, 2013 CNBC interview she said that “We’re in Nirvana for housing”.

I remember that in 2009 many people were prematurely betting on a rebound in housing. They were a few years too early but now I think that the worst is over for homebuilders.

Why I probably won’t own homebuilders

The problem is that I’m a terrible macro investor. I’ve lost money betting against long-term US treasuries, betting on natural gas and oil going up, betting against investment banks, etc. etc. My predictions about commodity prices and macroeconomic trends seem to be no better than randomly throwing darts. Because of this, I need to be more careful about stocks that are sensitive to their macroeconomic environment. It would be sensible for me to stay away from such stocks if I don’t see a margin of safety or a very compelling valuation.

Short selling

On the short selling front, homebuilders aren’t that awful compared to junior mining, oil & gas, pharma, etc. The level of fraud is very low. The management teams are fairly good thanks to survival of the fittest. The incompetent management teams were largely wiped out by the collapse of the US housing bubble. Valuations are reasonable (neither too high or too low) given the the market for new homes has improved.

At the moment, the only homebuilder I am interested in shorting is CHCI. Unfortunately the borrow costs over 10% and the market cap is $26M. I do not like shorting companies with less than a $100M market cap, partly because these shorts take up lots of margin but mostly because I do not like shorting beaten down stocks.

*Disclosure: No position in any homebuilders.

If you are comfortable with shorting ‘bad’ companies, and you feel comfortable with your ability to force rank return prospects for a given industry sector, that’s the hard part.

Question: In general, why not just go long the one or two companies in the sector that you relatively like, and short the couple that you really don’t?

This is glossing over a couple of important details, but at a high level such a strategy would make you sector neutral and help minimize the role of macro events.

Such a strategy would be somewhat similar to “pairs trading”. What I don’t like about hedged strategies is that the hedge won’t always work. The share prices of the bad homebuilders might go up while the good homebuilders go down.

Nowadays, I think that there are strategies with better risk/reward that I could pursue.

i used to hate homebuilders. for some reason i went long TPH. i’m not sure this adds anything but i feel like it’s a decent business 😀